There are many different ways to invest in the kids that we serve.

If your preferred method doesn’t appear below, email us or call 1.720.981.2532 ext 100.

Online Gifts

Are you interested in giving online today in support of our mission? Click here to make a secure online gift by credit/debit card or electronic funds transfer (EFT).

Checks or Cash

Checks made payable to the John Austin Cheley Foundation or A Thousand Summers can be mailed to:

John Austin Cheley Foundation

1420 N. Ogden St. Suite 102

Denver, CO 80218

Recurring Gifts

Are you interested in making a monthly, quarterly or annual donation? Click here to set up your donation today and become a member of our Trailblazer Program, making a significant impact on a camper’s summer. Just $25 a month will provide a camper with equipment and help fund their camp store account. Questions? Contact us by email or phone 1.720.981.2532 ext 100.

Donor Advised Funds

Are you interested in making a gift or recurring donation from your Donor Advised Fund? Grants made to the John Austin Cheley Foundation (A Thousand Summers ) through Donor Advised Funds can be designated for A Thousand Summers to use wherever the need is greatest or aligned with areas that match our supporters’ interest, such as camperships or program development. Click here to make your gift today!

Cryptocurrency

Are you interested in making a gift of digital assets like cryptocurrency to help us send more kids to camp this summer? Gifts made to the John Austin Cheley Foundation (A Thousand Summers ) can be designated for use wherever the need is greatest or aligned with areas that match our supporters’ interest, such as camperships or program development. Click on the button below and make your gift today!

Tribute Gifts

When you make a gift to the John Austin Cheley Foundation or A Thousand Summers in honor of or in memory of a loved one, you are not only supporting the kids in our program, but you are recognizing those that you love in a very special way.

Honor a special person or celebrate the life of a loved one by making a tribute gift today. Making a tribute gift is a special way to honor and remember or celebrate important occasions such as birthdays, anniversaries, weddings and graduations or honor a friend or family member.

Making a tribute gift in memory of a loved one or a special friend who has passed is also a lovely way to remember them as well as support the children in our program.

All tribute gifts will be recognized in our annual reports and a special card will be sent to the friends and family that you designate, informing them of your contribution. If you wish to notify the honoree or his or her family of your gift, please provide contact information when you make your gift. The amount of the gift is not disclosed.

Gifts may be made online, by phone at 1.720.981.2532 ext 100 or by mail:

John Austin Cheley Foundation

1420 N. Ogden St. Suite 102

Denver, CO 80218

When giving by mail, please let us know the person’s full name and whether the gift is in memory of or in honor of.

When giving online, complete the “Notes” section of the giving form. Where prompted, choose your tribute type (in memory of or in honor of) and the person’s full name.

Additional information and services:

If you’d like to include the John Austin Cheley Foundation in an obituary announcement, we recommend the following wording that can be personalized to your needs:

Memorial contributions may be made to the John Austin Cheley Foundation. Please direct your gift to [fund] in memory of [name]. Gifts may be made online, by phone at 1.720.981.2532 ext 100 or by mail: John Austin Cheley Foundation, 1420 N. Ogden St. #102, Denver, CO 80218.

For information on how to start a memorial gift fund or if you have any other questions, please email us or call 1.720.981.2532 ext 100.

Gifts of Stock

Gifts of stock are a wonderful way to support our Campership Program. As you make the transfer, please email us or call us at 1.720.981.2532 ext 100 and let us know the specifics of your securities transfer (name(s) of stock, how many shares, and other pertinent information). Donor names generally are not provided when gifts come into our account so please include your name and contact information in your email to us. This helps us facilitate matching the gift to you and providing a receipt more quickly.

- Download our stock transfer instructions.

- If your brokerage firm is Charles Schwab, please complete the Charles Schwab Stock Gift Form.

- For gifts of mutual funds or other investments from a brokerage firm other than Charles Schwab, please complete the Stock/Securities Transfer Form

- Email us or call 1.720.981.2532 ext 100 if you have any questions.

IRA Charitable Rollover

If you are 70 ½ years of age and older, you can take advantage of a simple way to benefit A THOUSAND SUMMERS and receive tax benefits in return. If you are interested, you can give any amount up to $100,000 per year from your IRA directly to a qualified charity such as ours without having to pay income taxes on the money. This popular gift option is commonly called the IRA charitable rollover, but you may also see it referred to as a qualified charitable distribution, or QCD for short.

Beginning in 2023, you can also choose to make a one-time distribution of up to $50,000 from your IRA to create a new charitable gift annuity (CGA) or charitable remainder trust (CRT) that also benefits the charity of your choice.

Another recent change that took effect as of January 1, 2023, is the beginning age for the required minimum distribution (RMD) from retirement plans has now changed from 72 to 73 years of age. Nonetheless, a donor can still make a charitable distribution from an IRA beginning at age 70 ½ and pay no tax on the distribution. Click here for our SECURE 2.0 Act of 2022 Fact Sheet for additional information.

Why Consider This Gift?

- Your gift will be put to use today, allowing you to see the difference your donation is making.

- You pay no income taxes on the gift. The transfer generates neither taxable income nor a tax deduction, so you benefit even if you do not itemize your deductions.

- Since the gift doesn’t count as income, it can reduce your annual income level. This may help lower your Medicare premiums and decrease the amount of Social Security that is subject to tax.

- There are other ways to benefit from a gift from an IRA, so be sure to consult with your tax professional to learn more about how this can benefit you personally.

Employer Matching Gifts

Many employers sponsor matching gift programs and will match charitable contributions made by their employees. They are a great way to maximize personal contributions to the John Austin Cheley Foundation and increase the impact of a gift. By taking advantage of your company’s matching gift benefit, you may be able to double or even triple the amount of your contribution. To find out if your company has a matching gift policy, please contact your employer’s Human Resources Department or enter your employer’s name in the search box below.

If your company is eligible, contact your employer for instructions on how to request the match. The impact of your gift to the John Austin Cheley Foundation may be doubled or possibly tripled. Some companies will also match gifts made by spouses of their employees and/or retirees.

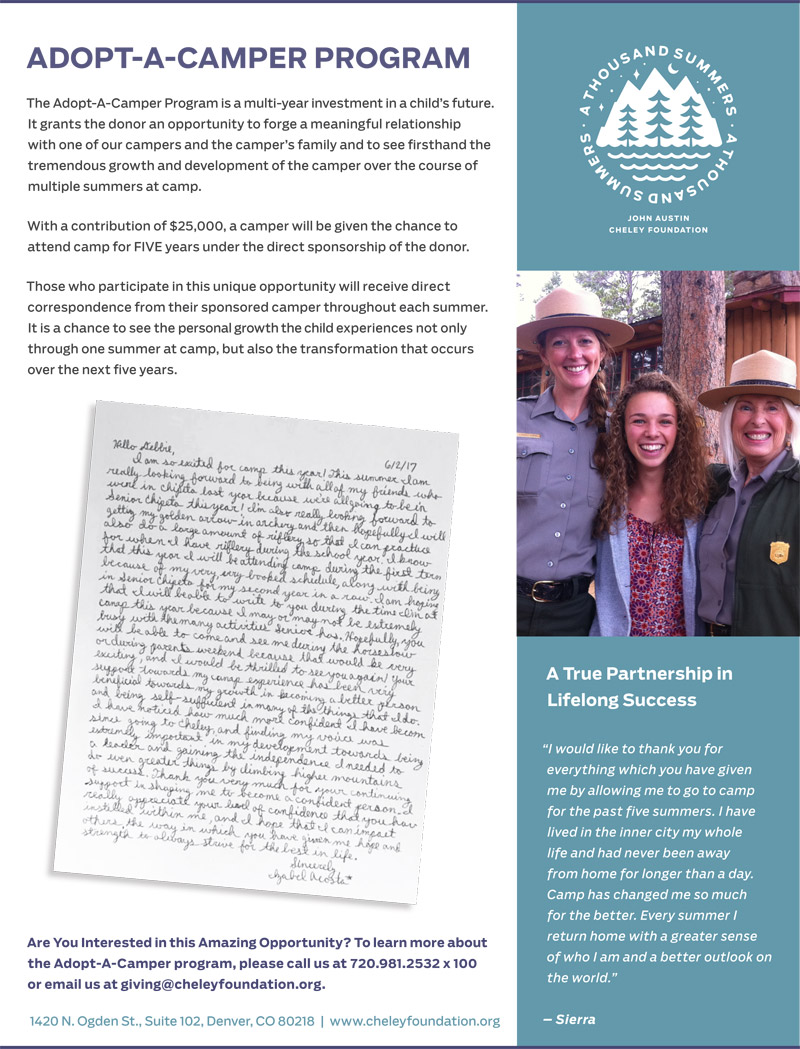

Adopt A Camper Program

The Adopt A Camper Program is a multi-year investment in a child’s future. It provides the donor with an opportunity to forge a meaningful relationship with one of our campers and their family, showing firsthand the tremendous growth and development that happens as a result of the camp experience.

The unique opportunity that is the Adopt A Camper Program has been highly meaningful to our donors, creating relationships that go well beyond the usual donor experience.

With a contribution of $25,000, a camper will be given the chance to attend camp for FIVE years under the direct sponsorship of the donor.

What could be a better investment?

Hear Why Sondra Eddings Chose To Become A Patron Of The Adopt A Camper Program

To learn more about the Adopt A Camper program, please email or call 1.720.981.2532 ext 100.

Endowed Campership Program

An Endowed Campership is a tremendously significant investment in the future of the young people we serve. It is a named fund established through a $150,000 gift that is restricted to sending a child to camp in perpetuity.

Hear Why Martha & Andy Livingston Chose To Become Patrons Of The Endowed Campership Program

To learn more about establishing an Endowed Campership, please email or call 1.720.981.2532 ext 100.

Many thanks to our generous supporters who have invested in the Endowed Campership Program. The following funds have been established:

- Craig I. Colvig Fund

- Reverdie & Jean Ater Memorial Campership

- Sis Cheley Memorial Endowment Fund

- John C. Lebor Memorial Campership Fund

- The Robert Perkins Campership Fund

- Kundtz/Tuohy Endowed Campership

- Laura Naugle Sanborn & Mary Colvig Miller Campership

- The Carol Hershey Periard Family Fund

- Anna Belle Kritser Memorial Fund

- John T. Jackson Endowed Campership

- Mary E. Satter Endowed Campership

- The Brown Family Campership Fund

- Williams Family Campership Fund

- Livingston Family Fund

- Ann Kuhn Endowed Campership Fund

- Jack Cheley Endowed Campership Fund

- Deborah J. Chaloud Campership

- Barbara Elaine Emmons Endowed Campership

- Andy & Nancy Thompson Campership Fund

- Robert H. Bell Family Fund

Other Ways To Support Us

Shop at King Soopers or City Market

It’s so easy! Designate the John Austin Cheley Foundation as the preferred nonprofit on your loyalty account with King Soopers/City Market and a percentage of your total purchases will support our programs and the campers we serve!

1. Visit kingsoopers.com or citym

2. Under “Sign in” go to “My Account” and sign in to your loyalty card account.

3. Select “Community Awards.”

4. Under “Find an Organization” type in HN312 or John Austin Cheley Foundation and then click “Enroll.”

5. Tell your family and friends! – click here to download a flyer to share with others.

Remember to swipe your registered King Soopers or City Market loyalty card or use the phone number associated with your card whenever you shop for each purchase to count.

After you enroll in the Community Awards program, King Soopers will send quarterly distributions directly to the Foundation based on a percentage of your total purchases. Due to privacy laws, the Foundation will not receive individual donation information.

Round Up When You Shop at Walmart.com

Support the kids that we serve every time you shop. Donate spare change by automatically rounding up your orders to the nearest dollar at checkout.

1. Click here to find our profile on Walmart.com

2. It might ask you to sign in. Once you are signed in click on the blue button that says “Make this my preferred charity”.

3. Once the blue button is clicked you will see a confirmation message confirming your choice.

4. You are all set! Thank you for supporting our mission through this program.

ReFUND CO – Refund What Matters

If you live in Colorado and you get a state income tax refund you will have a new opportunity to donate some or all of it to support our ongoing work in the community.

The new ReFUND CO initiative puts you in charge of where your donation goes. It’s as simple as 1,2,3:

1. Decide how much of your refund to donate.

2. Enter John Austin Cheley Foundation and our registration number 20033007104 in the Donate to a Colorado Nonprofit Fund line on your state income tax return or tax software – or just give this information to your tax preparer when you share your tax documents.

3. Smile knowing you’ve helped a cause that matters to you.

Note: Coloradans who choose this method of donating will not automatically receive a tax receipt or acknowledgment from the John Austin Cheley Foundation as state income tax filing information is confidential. Instead, if you would like a full receipt, please send a copy of your Voluntary Contribution Schedule with your SSN blacked out – along with your name by email.